Company Overview

From Asia’s first gas station-based REITs

To a future-ready investment platform REITs

operational

stability

revenue

streams

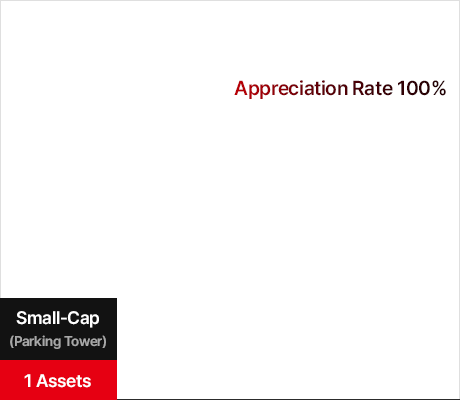

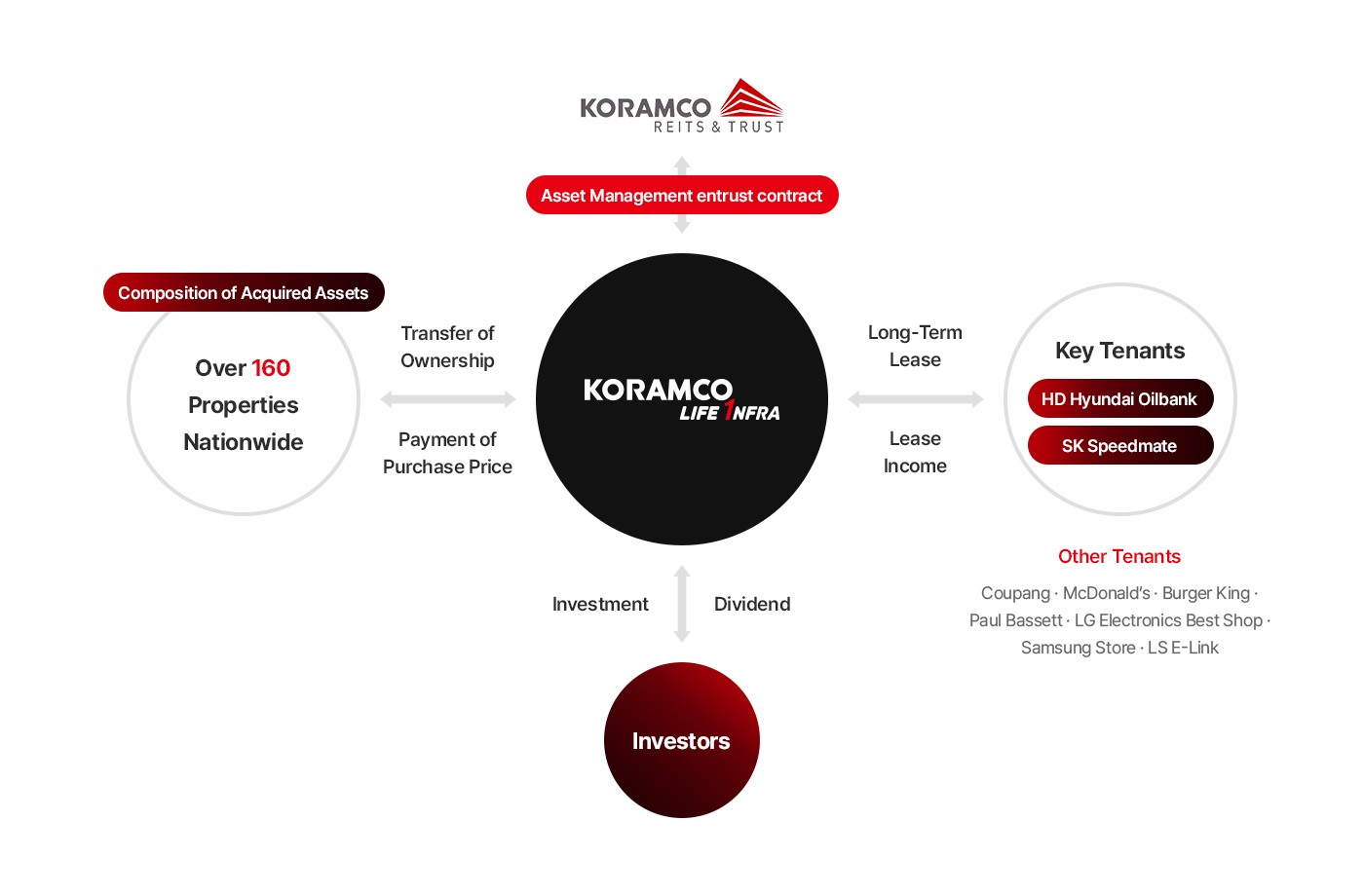

operating 160+ directly managed gas stations acquired from SK Networks to generate and distribute income to its investors.

KORAMCO LIFE INFRA REIT

KORAMCO LIFE INFRA REIT has secured operational stability through HD Hyundai Oilbank, while enhancing profitability by converting its assets into high-value facilities— including large-format electronics stores for Samsung and LG, fulfillment and last-mile logistics centers for Coupang, EV charging stations operated by LS Group, and drive-thru outlets for major F&B brands such as McDonald’s and Paul Bassett.

By shifting away from its original single-use gas station lease structure, the company has transformed into a lifestyle infrastructure REITs that integrates mobility, retail, and culture.

It has returned special dividends to investors through gains from the disposal of non-core gas stations, while pursuing future growth through new investments in mid-sized hotels and preferred equity in DF Tower.

Moving forward, KORAMCO LIFE INFRA REIT will continue to reinforce its position as Korea’s leading growth-oriented REITs through proactive and agile portfolio rebalancing strategies.

KORAMCO LIFE INFRA REIT

Entrusted Real Estate Investment Company

Date of Establishment

December 10, 2019

Head Office

511, Samseong-ro, Gangnam-gu, Seoul, Republic of Korea

Asset Management Company

KORAMCO REITs Management and Trust Co., Ltd.

Key Tenants

HD Hyundai Oilbank

SK Speedmate

LS E-Link

Coupang

Market Kurly

Key Milestones

(KORAMCO LIFE INFRA)

Investment Structure

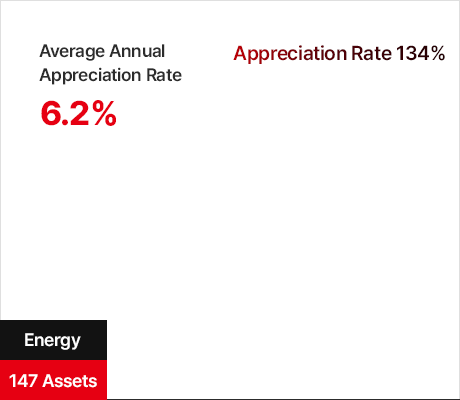

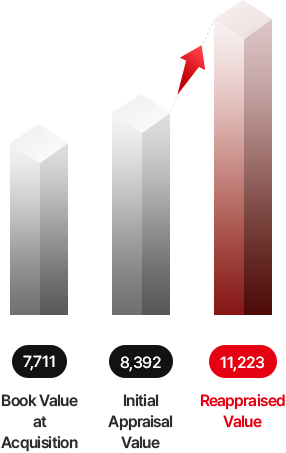

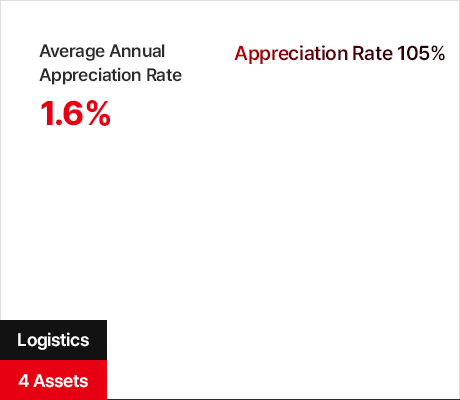

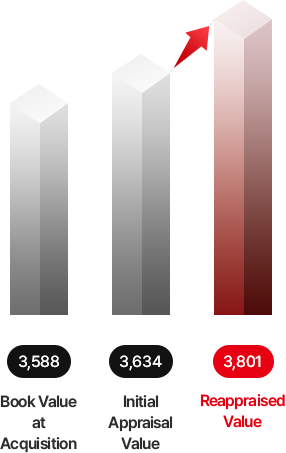

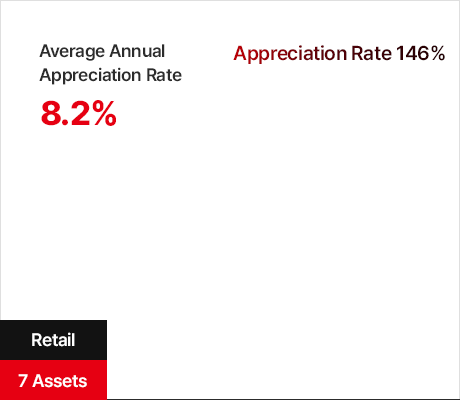

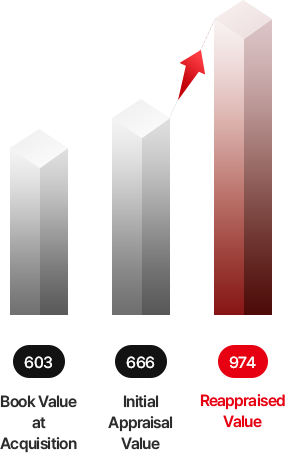

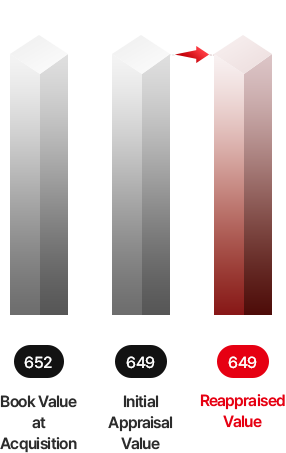

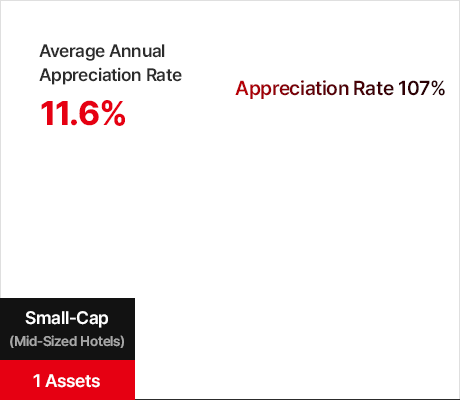

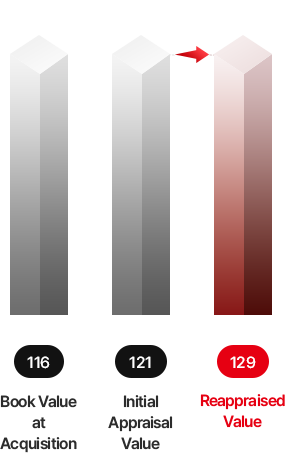

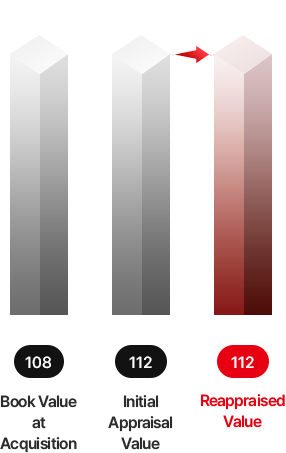

Asset Analysis

* Growth Rate: Asset Reappraised Value / Initial Appraisal Value

1) The initial appraised values are based on market valuations conducted by Jungang Appraisal for gas stations (May 2020) and by Nara and Kyungil Appraisal for logistics centers (March 2022).

2) The reappraised value as of March 2025 (Kyungil Appraisal) is currently under review, and it has not yet been determined whether it will be reflected in the book value under the fair value model for investment properties.