Management Strategy

Differentiated Management Strategy of Korea’s No.1

Private REITs AMC for 24 Consecutive Years

Leveraging the core capabilities of KORAMCO REITs Management and Trust, KORAMCO LIFE INFRA REIT continuously enhances stability, profitability, and growth potential.

-

Growth Potential

A flexible structure that enables the agile inclusion of high-growth sectors, accelerating external expansion

- - Strategic restructuring of the asset portfolio across key regions

- - Unlocking development potential through prime location

-

Profitability

Maximizing profitability through synergies across a diverse mix of sectors, tenants, and investors

- - Development of a Mobility-Retail Platform

-

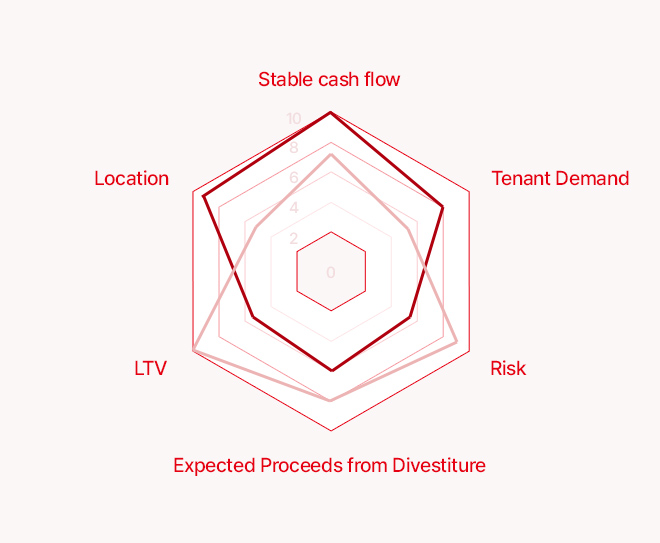

Stability

Minimizing exposure to unsystematic risk through portfolio diversification

- - Stable and predictable dividend yield outlook

- - Hedging against key risk factors

- - Securing steady rental income through Key tenants

| Category | Service Type | Tenant | Details |

|---|---|---|---|

| Key Tenants | Gas Station |  |

- Credit Rating: AA– (NICE Investors Service, as of June 2025) - 10-year long-term lease - Car wash and convenience store facilities at select stations - One-time 5-year lease extension option |

| Auto Service (SK Speedmate) |

|

- Credit Rating: AA- (NICE, as of October 2024) - 10-year long-term lease |

|

| Logistics Center (Fulfillment) |

|

- Up to 10-year lease term |

|

| Logistics Center (Last Mile) |

|

- Up to 10-year lease term |

|

| Development and Operation of EV Charging Infrastructure |  |

- 15-year long-term lease |

|

| Other Tenants | QSR (Quick Service Restaurant) |

|

- Global F&B brands operating on-site - Drive-thru sales showing strong growth |

| Others |  |

- Enhancing profitability through efficient use of idle land |

-

Investment Strategy

- - Investing in high-quality real estate at prime locations

- - Establishing long-term, B2B-oriented lease structures

- - Targeting real estate sectors with demand exceeding supply

-

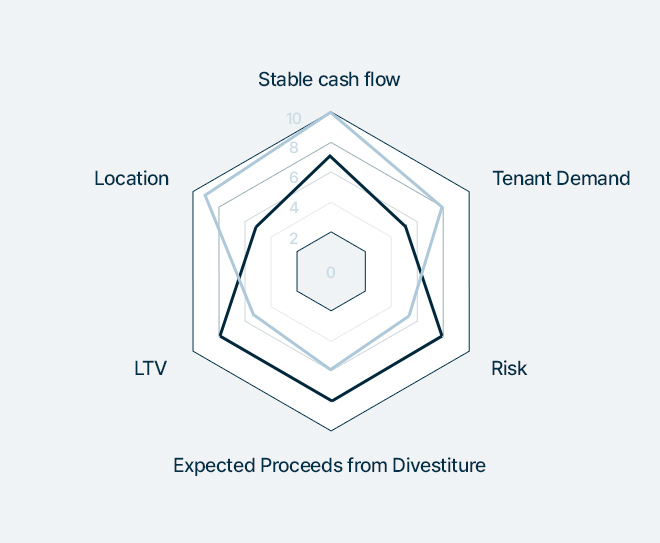

Investment Impact

- Generate Income gains

- through stable cash flow

-

Investment Strategy

- - Enhancing returns through optimized land utilization

- - Converting properties into next-generation business assets

- - Strategic disposal of repurposed or redeveloped assets

-

Investment Impact

- Generate capital gains

- by delivering special dividends and increasing stock price

-

Core Investment Strategy

-

Indirect investments in preferred equity

-

Joint investment strategies with strategic and financial investors (SI & FI)

-

Pre-acquisition of project REITs

-

-

Value-Add Investment Strategy

-

Investment in Distressed Assets

-

Targeting small-cap real estate opportunities

-

Leveraging entitlements and development rights to unlock value from existing assets

-

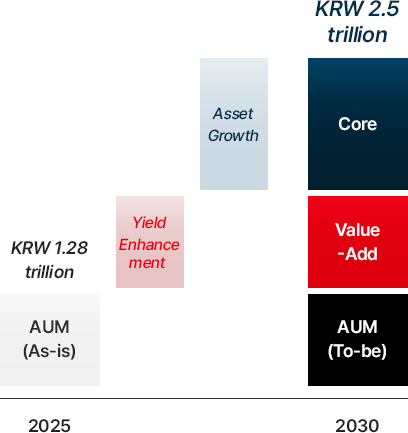

Securing New Growth Drivers and Stable Dividends

Energy

(Industrial)

Logistics

Retail

Hospitality

Office

Residence

Mobility

-

Value-Add

Value-Add

- Enhancing asset value through strategic repurposing

- Improving Dividend Yield through Investments in stable, high-yield assets

-

Core

Core

- Expanding portfolio size by acquiring high-quality, stable assets

- Reducing funding costs through economies of scale

-

Direct Asset Acquisition

Direct Asset Acquisition -

Indirect Investment

Indirect Investment -

Asset Repurposing

Asset Repurposing -

Special Dividends

Special Dividends

Achieving sustainable growth through increased shareholder value